No business owner enjoys paying tax but when the Chancellor of the Exchequer raised the rate from 19% to 25% in the 2021 budget you could be forgiven for thinking that there was an audible sharp intake of breath from companies across the UK.

The blow was softened by the fact that the increase related to tax years from 2023 onwards and whilst that perhaps helped a little, 2024 soon came around and this is the year that the payments will start to be made.

So how do you cope with a 25% tax rate and what can you do about it?

In this article, we are looking at the new rate and give you some tips to manage what is becoming an ever-larger bill.

We cover;

- What is corporation tax?

- UK corporation tax rates

- Marginal corporation tax relief from 1st April 2023

- Allowable expenses

- The full expensing change

- Other major allowances

What is corporation tax?

You can think of corporation tax as income tax for businesses. However, unlike individuals, companies don’t get a personal allowance so tax is payable on every pound of income.

Like all parts of the UK tax code though, there are a lot of nuances involved with plenty of allowable expenses, some non-allowable costs and some investments that can be made tax-free.

UK corporation tax rates

In simple terms there are two main rates of corporation tax in the UK;

Small profits rate = 19% – for companies with an augmented profit of £50,000 or less (The lower rate)

Main rate = 25% – for companies with an augmented profit of £250,000 or more (The upper rate).

But within those two rates, there are a lot of more complex rules.

Firstly, the ‘profit’ mentioned above is, in HMRC terms, ‘Augmented profit’.

This is trading profit, plus exempt income from dividends or distributions but excluding dividends from 51% group companies. In other words, the profit is based on a single company, not on group profits that have been distributed through dividend.

Secondly, the thresholds are amended depending on the number of months you have in your tax year. So if you are reporting for six months then your lower limit will be £25,000.

Similarly, the rates are reduced if you have associate companies. If you have two associated companies then the threshold will be halved, if you have four it will be one quarter.

Marginal corporation tax relief from 1st April 2023

The sharp-eyed among you will have spotted that there is a gap in the tax rates for businesses that have profit between £50,000 and £250,000 and this is where the tax rate calculation gets a little tricky.

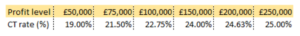

Companies with profits above £50,000 and below £250,000 are required to apply a marginal tax rate dependent upon the value of profits they make. This means in practice that a company that makes £100,000 in taxable profit will pay a lower rate than one that has £200,000 in profit.

The formula for the marginal rate is a little bit complex but for the sake of completeness, in the legislation, it is expressed as – F x (U-A) x N/A where;

U = Upper limit

A = Augmented profits

N = Taxable total profits

F = Standard marginal relief fraction (3/200)

In essence, this comes down to an effective corporation tax rate as per the table below.

The good news is that HMRC has devised an online calculator to help you manage your corporation tax marginal rate. You can find this here.

Allowable expenses

If you aren’t keen on paying tax on all of your profit then there are a number of expenses that you can offset against income.

All of the normal expenses of running a business are allowable such as rent, salaries and software costs.

But you can also charge certain items to profit that may prove helpful for the director of a business.

For example, pension costs are fully chargeable to the business as is the cost of a mobile phone and gifts to employees that are below £50. Life insurance as a death in service benefit, uniforms and protective clothing, travel expenses and reasonable expenses when working away from the office can also be deducted from profit.

Be careful though as the cost of entertaining business contacts, everyday clothing and that pesky parking fine aren’t allowable. Also, remember that the cost of an investment in capital assets like plant and machinery or computers isn’t an expense (see below).

We really would suggest that you get advice from a qualified accountant before submitting your tax computations!

The full expensing change

One of the main costs that you can claim against tax is the value of investing in equipment for your company.

In most cases, you will be allowed to claim a capital allowance that is a percentage of the total cost for each year of ownership.

However, the 2023 budget brought in another innovation in allowances – full expensing.

Put simply, full expensing means that an investment in certain types of capital equipment is charged in full against profits.

The types of qualifying assets are;

- Computers and printers

- Office equipment such as desks and chairs

- Some fixtures and fittings including kitchen and bathroom fittings

- Lathes and planers

- Warehousing equipment such as forklift trucks, pallet trucks, shelving and stackers

- Vehicles such as vans, lorries and tractors (but not cars)

- Construction equipment like excavators, compactors, and bulldozers

- Smaller tools such as ladders and drills

- Fire alarm systems in non-residential properties

With a little judicial planning, a business might time its capital expenditure to reduce the effective tax rate or indeed wipe out its corporation tax altogether which underlines the need for effective and knowledgeable advice before making any decisions.

Other major allowances

As we have seen a company can use full expensing as a way to remove a corporation tax bill altogether but a good accountant will tell you that there are many other allowances that will help too.

Space stops us from exploring these in great detail but briefly, you could look at;

R&D Tax credits

R&D tax credits provide tax relief for money spent on developing new products. There are strict rules and just like Corporation Tax, there are two rates which are dependent upon the size of the company.

If your company is not profitable you can still make a claim and receive a cash payment instead of a tax credit.

Annual Investment allowance

Every company has an Annual Investment Allowance (AIA) which is currently £1m.

This can be spent on a variety of asset investments and allows you to charge the full amount against your company’s tax bill.

In common with other reliefs, there are rules around what you can and can’t spend money on so make sure you get advice before making any decisions.

Patent box

If you receive income from a patent established in the UK, EC or several other European nations then you can opt to be taxed at a lower rate (currently 10%).

You must have a company that is subject to corporation tax and you have to allocate income stream to patent box at the outset to benefit.

Creative Industry Tax Relief (CITR)

Applying to creative industries and covering traditional sectors such as theatres and museums but also video games and high-end TV production, the Creative Industry Tax Relief scheme includes 8 different allowances and reliefs that help businesses invest in the sector.

Capital allowances

If none of these are applicable or if you have hit your AIA ceiling then you can also use capital allowances.

These give companies the opportunity to charge a percentage of the purchase price of an asset against corporation tax each year.

As you would expect there is a long list of rules that need to be adhered to but capital allowances do provide a very useful tax reduction opportunity.

Trading losses

All of the allowances we have covered so far relate to tax paid on profits in the current tax year but there is another way to reduce tax that relates to other years.

If your company makes a trading loss, or you are a member of a group with some loss-making companies then you can offset these against future years ( carry forward) or set them against the profit made in a former year (carry back).

For profits since 2017 there is a limit of £5m plus 50% of the remaining total profits after deduction of the allowance that you can use but that is still a very useful amount.

Don’t chance it – take advice early

So we have seen that the large increase in the corporation tax rate will prove to be a burden for many profit-making companies.

We’ve also seen that there are a large number of ways that sensible use of allowances and reliefs can massively reduce or even eliminate a corporation tax bill.

But there is an underlying theme in all of these allowances and that is that there are a lot of rules surrounding them and they need to be applied correctly for them to be effective.

If there is one piece of advice we’d give it is that company directors should seek help very early on, before their year-end and even before they make any investment decisions. Put simply, timing is everything and if you get it right you can make full use of tax planning strategies.

Call us now and we’d be happy to have an initial chat about your tax planning strategy and show you how we could help.